The Inner Circle Trader (ICT) Macro Time Strategy stands out as a robust methodology, harnessing distinct time stamps to elevate the precision of trading choices.

It helped me a lot in my trading journey and trust me this ICT Macro time strategy works great if you know how to utilize the most out of it.

Therefore, based on my 2 year experience of trading with ICT concepts, I am writing this article which delves into the intricacies of ICT Macro Time, unraveling its nuances and illustrating how it proves instrumental in refining and maximizing trading results.

ICT Macro Time

ICT Macro Time entails identifying some important time intervals during the trading day when the algorithm aims to attack the buy stop(buy-side liquidity) or sell stop (sell-side liquidity). It also seeks to rebalance prices strategically at significant points of interest between the market open and close within the macro time.

In this period, Forex traders can identify trading setups with a high probability of success. This is attributed to the heightened activity of algorithms during these moments, actively pursuing and targeting liquidity in the market.

ICT himself and most of his students believe that there is some sort of High-Frequency Algorithm, running in the market. You can hear him saying it multiple times if you have gone through his mentorship which is available freely on YouTube.

I personally like the 2022 ICT mentorship, which helped me reach profitability after struggling to make consistent profit trading chart patterns, trendlines, and other retail stuff. Personally, it surprised me when I heard him saying that the market is controlled by some algo. But in the end whatever, he teaches those stuffs really work in the market.

Macro timetable in EST

Most of the ICT traders usually trade during the London session or New York session (me included) and avoid trading in the Asian session. Keeping that point in mind, I am listing all the macros provided by ICT for the London trading session and the New York trading session.

| Session | Macro starting time(EST) | Macro ending time(EST) |

| London | 2:33 AM | 3:00 AM |

| 4:03 AM | 4:30 AM | |

| NY AM session | 9:50 AM | 10:10 AM |

| 10:50 AM | 11: 10 AM | |

| NY Lunch | 11:50 AM | 12:10 PM |

| NY PM session | 1:10 PM | 1:40 PM |

| 3:15 PM | 3:45 PM |

ICT Macro timetable in GMT

| Session | Macro starting time(GMT) | Macro ending time(GMT) |

| London | 6:33 AM | 7:00 AM |

| 8:03 AM | 8:30 AM | |

| NY AM session | 1:50 PM | 2:10 PM |

| 2:50 PM | 3: 10 PM | |

| NY Lunch | 3:50 PM | 4:10 PM |

| NY PM session | 5:10 PM | 5: 40 PM |

| 7:15 PM | 7:45 PM |

Inner Circle Trader (ICT) Macro Trading Strategy

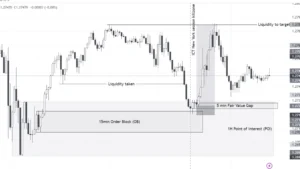

- Open a 5-minute chart before starting of any macro time period and mark the buy-side liquidity or equal highs and sell-side liquidity or equal lows. Now mark the inefficiency on your 5-minute charts. These inefficiencies can be Fair Value gaps(FVG) or Inverse Fair Value gaps(iFVG)

- Now shift to 1 1-minute timeframe and wait patiently for the High-frequency algorithm to either fill an imbalance or take out any liquidity that you have marked based on your 5-minute chart.

- Once you witness any one of these 2, wait for a Choch (Change of Character) or MSS ( Market Structure Shift ).

- Now in accordance with your daily bias, take your enty.