New traders often get confused when they come across some terms like ICT order blocks or Points of interest. As a newbie, it’s common for them, as they come from those chat patterns, trendline sort of fairyland. They assume it is some kind of indicator or pattern which are kept secret from them.

As a result, their inner curiosity makes them search for terms like “ICT Order block pdf” or “ICT order block indicator MT4 or MT5”.

Therefore, to clear all your doubts regarding ICT Order blocks or Institutional Order block( both are almost the same thing) I am writing this post after trading with the ICT concepts for more than 2 years in indices and the Forex market.

What actually is an ICT Order blocks?

The ICT Order Blocks also known as the institutional order block is a PD Array that is a crucial part of the Smart Money Concepts or Inner Circle trader(ICT) concepts, whatever you call it. These are some specific zones on the price chart where big players or institutional traders executed their Long or Short orders.

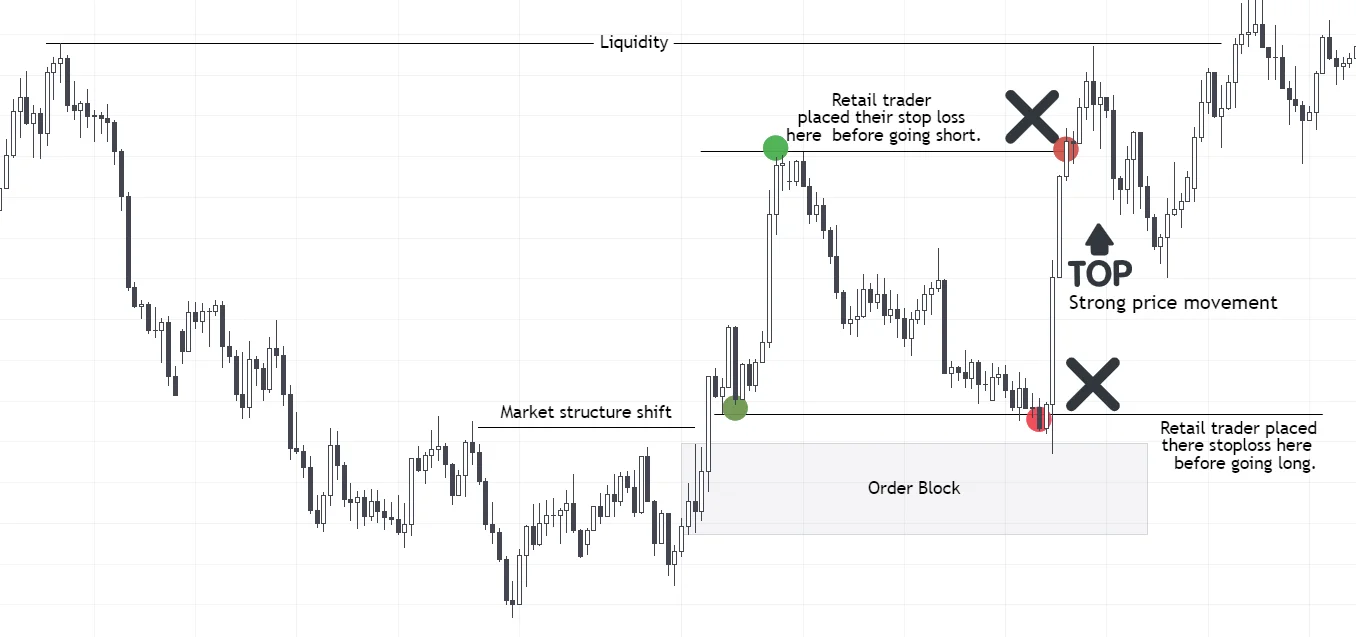

These specific zones hold great influence in price action, and market sentiment and are revisited by price to manipulate retail traders to go long or short, then show them some profits and reverse the price and grab the liquidity ( buy stop or sell stop hunting )required to fuel the market in opposite direction.

In simple words, Institutional traders show huge interest in moving the price in opposite directions from these types of zones which we call ICT Order Blocks.

In my 2 years of trading with ICT concepts, I found these points very crucial due to the aggressive movement of prices after reaching these zones.

The main reason behind these aggressive movements is the placing of a large number of orders by the institutes.

Which is worth millions and sometimes billions of dollars and since all those orders don’t get filled immediately, these smart money zones are often revisited to execute the pending orders after grabbing liquidity to move the price further.

Types of ICT Order Blocks with examples

If you are an Intraday Trader like me, 15-minute, 30-minute, or 5-minute time frames are great for finding Order blocks for entry purposes provided you have a clear daily or weekly timeframe bias in your trade.

There are two types of Order blocks,

1. Bullish Order Block

2. Bearish Order block

1. Bullish Order Block

A Bullish institutional Order Block is identified as the extreme down closed candle ( red candle in this case) in the discount zone(from 0-50% zone in your fib) before the price undergoes a notable and forceful upward surge. This block signifies a crucial level where institutional traders executed substantial buy orders, triggering a robust rally in the market from that specific point.

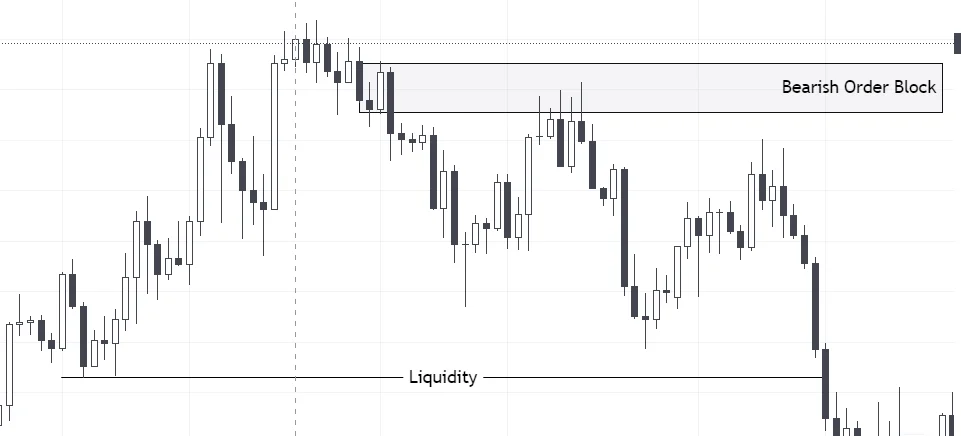

2. Bearish Order Block

A Bearish Order Block is distinguished by the concluding up-closed candle(green candle in this case) before the price undergoes a rapid and forceful downward movement. This block indicates an influential level where major market participants, including institutional traders, executed substantial sell orders, leading to a significant downturn in the market.

Through the identification and analysis of these Bullish and Bearish Blocks, traders can gain insights into potential aggressive reversal movements. They can effectively use this information to pinpoint opportune entry or exit points for their trades, enhancing their decision-making process in the market.

Trading order blocks extend beyond simply identifying the last up or down closing candle. To trade order blocks effectively, it is essential to consider several contextual factors, including:

1. Liquidity Grab or Hunt: Market participants, especially the big players or institutional traders, may strategically place their orders to trigger stop losses or create a liquidity imbalance. It is crucial to understand liquidity patterns and how they can influence price action.

2. Daily Bias of the Day: Determining the Bias of the day is very crucial before taking a trade solely based on a lower time frame order block. With a Bullish daily bias and price-delivering from a daily bullish Fair Value Gap (FVG) or a Daily Bullish ICT Order block, gonna violates all those lower timeframes bearish Order Block which might make you think gonna give you an aggressive short opportunity in that day.

3. Interest Rates and Fundamentals: Examining fundamental aspects such as NFPs, FOMCs, Unemployment claims, CPIs, and other red folder news listed in the forexfactory, is crucial, as these factors wield substantial influence over market conditions. Gaining a comprehensive understanding of how these elements interact with order blocks can offer valuable insights, aiding in informed trading decisions.

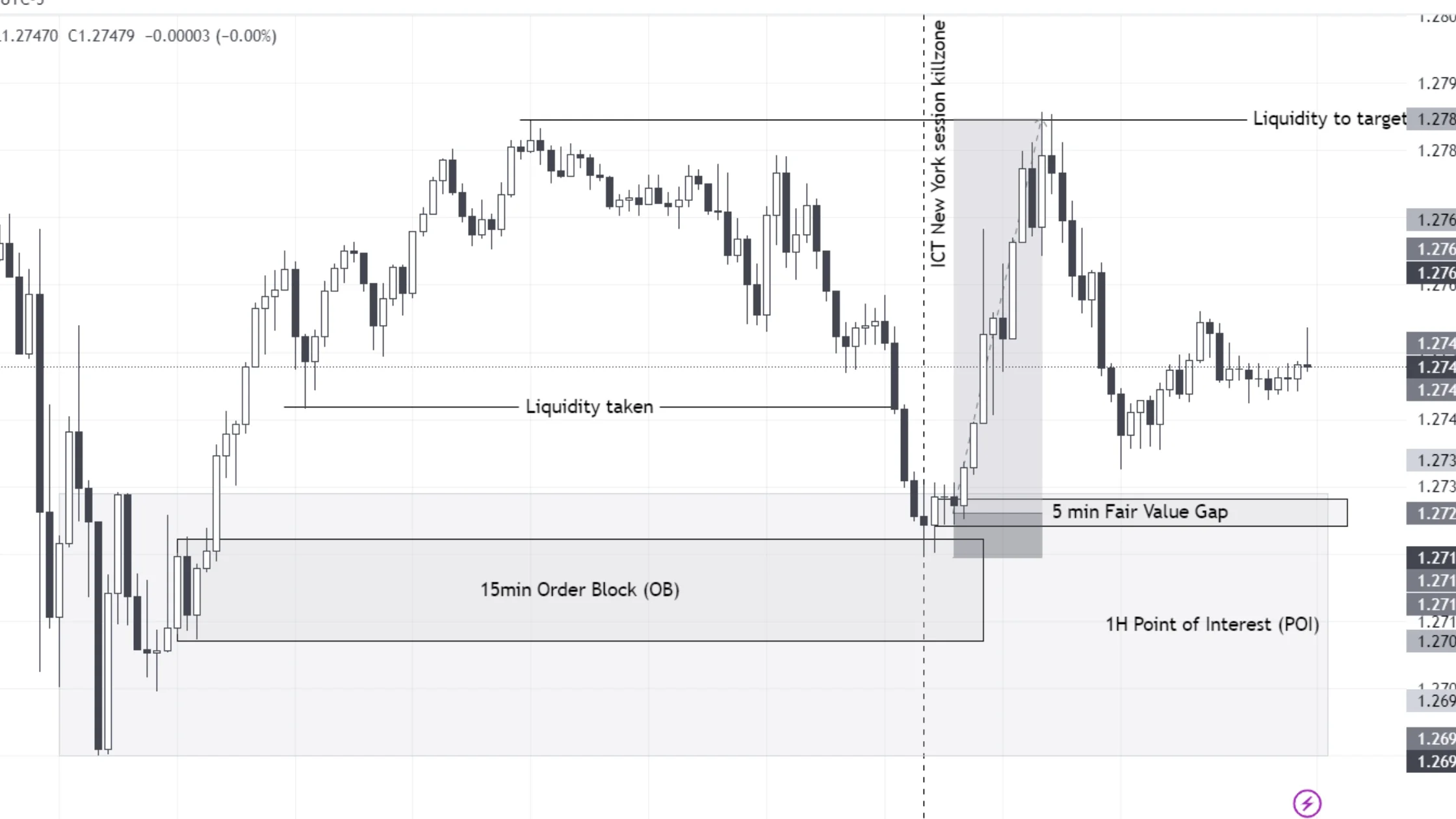

4. Kill zones: According to my experience, trades that are executed from an Order block during the London kill zones ( 2:00 AM to 5:00 AM New York local time) or New York kill zones( 7:00 AM to 10:00 AM New York local time) AM session is going to work better than other trades executed outside the kill zones.

By considering these contextual factors, traders can elevate their understanding of order blocks and make judicious trading decisions.

To identify order blocks, traders often scrutinize historical price movements on the chart. They focus on identifying areas where the market has exhibited robust aggressive reactions.

How to identify valid Order Blocks?

Identify strong Price Reactions: Scrutinize the chart to note areas where the price has demonstrated aggressive reactions, including sharp reversals, prolonged consolidations, or breakout instances.

Mark Potential Order Block Levels: After identifying areas with substantial price reactions, designate them as potential order block levels on your chart. These levels signify crucial price zones where institutional traders may have executed significant orders.

Note the presence of liquidity: If you identified a bullish order block, make sure there are some equal lows above it which serves the concept of support to the retail traders. In case of a Bearish Order block, make sure there are some equal highs present below your order block which serves the concept of resistance to the retail traders.

These are crucial points where retail traders place their stop loss before going long or short.

Note the presence of Fair Value Gaps: Make sure there is a Fair Value Gap (FVG) present below your Bearish Order Block and an FVG present above your Bullish Order Block.

Align your daily Bias: Make sure your daily bias is aligned with your bearish or bullish order block marked by you.

These points collectively are enough to help you find a strong and valid Order Block, which usually helps traders get a sniper entry and massive reversal moves.

How to trade ICT Order Blocks

I usually trade the ICT New York kill zones in the Forex market, therefore I am taking it into consideration in writing the steps.

- Identify Daily Bias: Select the Daily timeframe in your Forex chart, and determine the bias of the day, whether the price is going to expand higher or lower ( based on the liquidity present and premium or discount zone) before the start of the New York kill zone which is 7:00 AM to 10:00 New York local time for Forex for the AM session. Let’s say the expansion is going to be Bearish for that particular day.

- Identify Point of Interest (POI): Once you have your daily bias, drop down to 4 4-hour or 1-hour charts and identify your POI. POI is nothing but an Order block of a higher timeframe. Usually, these are areas where prices reacted sharply.

- Identify your Order Block: After step 2, drop down to 15 min or 5 mins chart before the start of your desired kill zones( I am considering ICT New York kill zones here). Identify your valid Order Block in this time frame in accordance with your daily bias and higher timeframe POI.

- Observation: Keep a note of how the price is reacting when it reaches your POI. Try to identify the strength of that POI based on the reaction made by the price. This will give you a clear view of whether the price is going to sustain it or violate it.

- Entry: Once you get the rejection idea from your POI. drop down to a lower timeframe and observe the price reaction from your order block and try to locate a Fair Value gap there. Place your pending buy limit or stop limit from that Fair Value gap. If the displacement is a big one, then your can place your pending order at 50% of your FVG.

- Stop Loss: The most crucial part of entering a trade is placing your stop loss to save yourself from loss, in fact, that particular trade goes against you. Place your stoploss within 1-5 pips outside of your Order Block.

- Targets: You can target the liquidity resting above equal highs or resting below equal lows.

Keep in mind that these guidelines offer a foundational structure for engaging with ICT order blocks in trading. However, it is imperative to craft a trading strategy tailored to your specific risk tolerance, trading preferences, and prevailing market dynamics.

Prioritize a comprehensive backtesting process and deliberate practice to refine your strategy before implementing it in live trading situations. Furthermore, staying well-informed about market developments and adhering to sound risk management principles are indispensable components for achieving success in your trading endeavors.